From Electric Uniformity to Complexity

Exploring locational pricing and flexibility in the UK energy transition. [Second Edition]

I used to think change was a transitional chaos that happened before order was restored. Now, I ponder: is this complexity, chaos, and constant change are the hallmarks of our modern system?

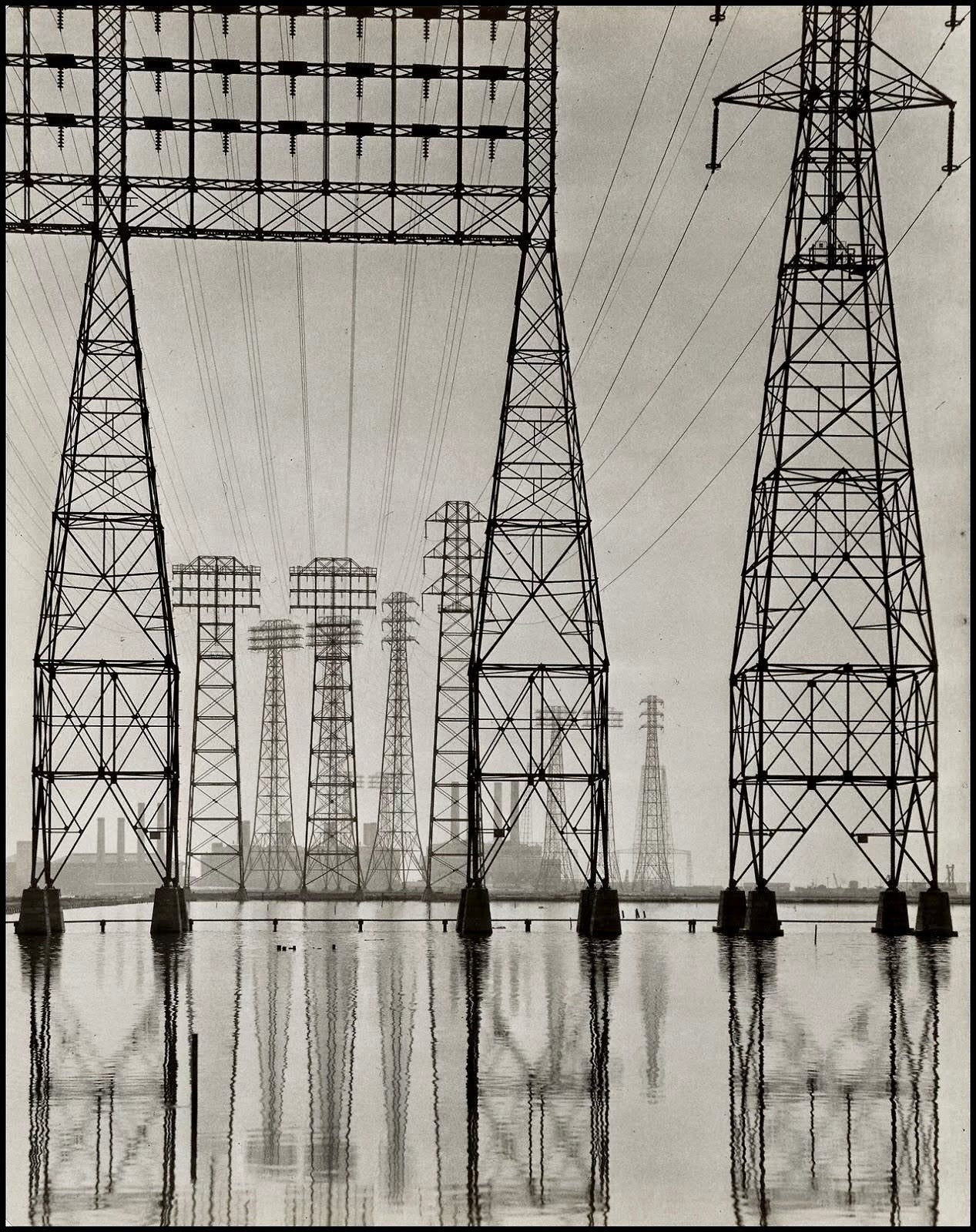

As we decarbonise and decentralise, barriers are lowered while we struggle to grapple with new technological requirements. Intermittent energy sources (like wind and solar) require stabilisation. Neither the consumption load profiles nor our circadian rhythms are perfectly coordinated with the generation, transmission, and location of electricity sources. This requires solutions.

This is particularly in the case of offshore wind in the United Kingdom, also known as Great Britain. Are the price signals accurate and sufficiently enticing to lower barriers and deliver swift solutions in this country?1

My answer is “no”.

The UK has rejected nodal and zonal pricing in GB.

The Review of Electricity Market Arrangements (REMA) is over. Wholesale pricing will remain uniform across the UK for the foreseeable future.

The UK / GB has its idiosyncrasies. Consider this: Texas is nearly thrice the size of Great Britain. It has a centralised dispatch system, in which the ERCOT centrally optimises generator offers across 520 transmissions substations and 9,000 nodal points to calculate pricing — this number includes 3,700 lower voltage distribution substations.

If that seems like a lot, Great Britain has approximately 280 transmission substations — yet 185,000 lower voltage distribution substations. This is designed to account for the higher population density, but it also points toward a quintessentially British decentralised system with loose control and power divided among multiple actors. This creates liberty, but also inefficiency.

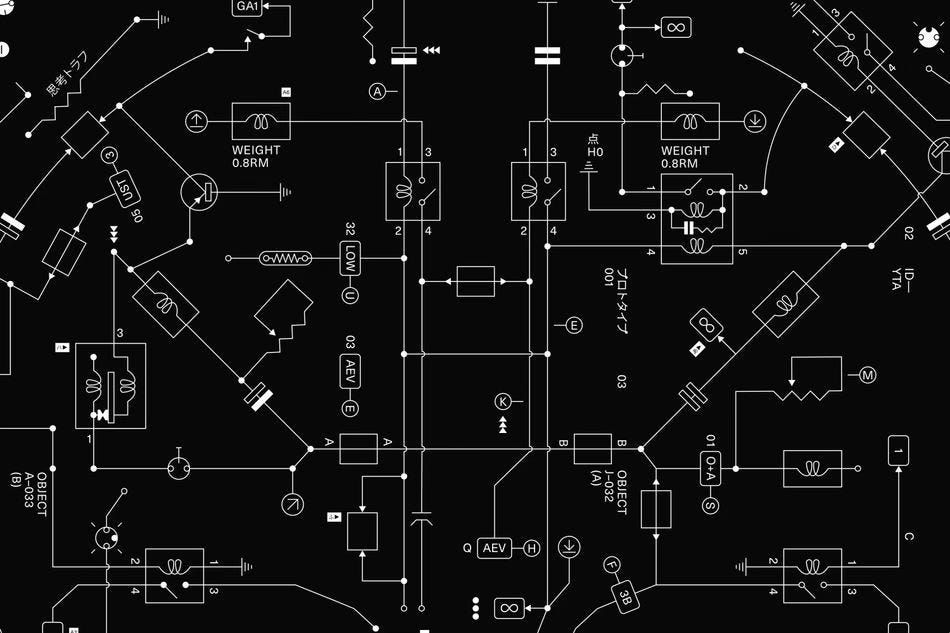

In contrast to the UK, Texas’ ERCOT’s nodal market has a central dispatch model whereby the system operator directly optimises around network constraints. Generators offer, ERCOT decides, and prices vary by node. ERCOT’s efficiency reduces the role of balancing.

In the UK, the market is settled through an acceptance of bids decided on a first-come, first-serve basis, and then solving the gaps or excesses left by the accepted bids determined not by a central arbiter, but by the generators. ERCOT’s efficiency removes the commercial incentives and opportunities created by GB’s self-dispatch model, where the Balancing Mechanism is a major revenue stream. Is it a righteous distaste for centralised control, or profitable inefficiency? Maybe both.

It is also true that the UK has a more collaborative approach across all counts — for instance, the UK relies on international interconnectors, whereas Texas remains isolated due to an emphasis on its regulatory independence. But I digress.

I see unaligned incentives in the United Kingdom with the current status quo. Wholesale prices are uniform, not locational — despite the abundance of substations. On a windy day in Scotland, excess supply and low demand push prices down, even into negative territory. A battery in London sees this cheap signal and is incentivised to charge — but in reality, transmission constraints may prevent Scottish surplus from reaching the South.

TLDR: The national wholesale price shared across all regions tells a story of surplus, while the local network may be tight. Flexibility responds to the wrong signal.

This decision to not calibrate locationally is for not for technical expediency. As we have examined, there is an abundance of calibration points to fine-tune the wholesale market pricing locationally. The decision is a question of political determination.

Now that it’s over, how can the UK calibrate more appropriately to avoid this perverse incentive created by wholesale prices?

While Transmission Network Use of System (TNUoS) charges are present to suppliers for demand charges and therefore affect these incentives, the overriding signal is the pricing. The physical constraints remain.

Enhanced geographic calibration is still required.

The TNUoS charging methodology could incorporate more dynamic elements — adding seasonal or time-of-day variations. Nonetheless, it still remains a long-term averaged, stable charge to be forecasted without much dynamism. It is the dynamism that provides this capability of responding to “tight” local networks accurately.

Addressing short-run locational and temporal issues would likely require deeper reforms to market design, such as shorter settlement periods to calibrate in real-time instead of relying on imprecise forecasts. But the more granular the signal, the more advanced the metering required, and this question of control must be examined along the rising costs of energy.

What positive calibration developments are underway?

Connection and Use of System Code (CUSC) is reviewing CMP316 to address inaccurate TNUoS charges for co-located sites. It’s doing so by addressing a long-standing distortion by pro-rating Transmission Entry Capacity (TEC) across technologies. Multi-technology sites (and particularly batteries) have historically been charged TNUoS charges as though they were exporting at the maximum capacity of the co-located generation asset.

So, instead of assuming every co-located asset as equal CMP316 is still under review as the equation for the accurate charges is worked out. If passed, it should reflect more realistically how distinct technologies are forecasted in the transmission system, in conjunction. This makes wind-plus-storage projects more viable and removes idle assumptions that block build-out. Particularly, co-located assets with batteries have the ability to absorb the peak of co-located generation if the network is in distress in logic with financial incentives. Batteries can ease overload as prices are lower (and export is undesirable. There is a notable financial incentive for batteries to absorb excess grid energy as prices become negative — which happens more as variable, clean renewables become a larger part of the energy mix.

Calibrating the TNUoS charges and therefore addressing constraints brings us closer to a charging system that better reflects the real-time costs imposed on the network. Shorter settlement windows sharpen temporal signals; they don’t solve spatial constraints. Even while wholesale pricing dominates the logic, more fine-tuned network entry calculations and charges pave the way for incentive calibration.

How does the market and regulatory landscape affect investment for batteries and their bidirectional potential? How can we examine this more thoroughly?

Transmission charging is a prime example, because even small tweaks to how storage is classified can radically change its cost base.

We already discussed how CMP316 begins questioning the long-term TEC assumptions on fixed entry capacity into the transmission system.

Relatedly, the CUSC reviewed modification CMP393, which affects the Generator Transmission Network Use of System (TNUoS) rates charged through the Annual Load Factor (ALF) by making them specific to the technology. High-ALF assets (wind, CCGT) are assumed to be exporting often and thus driving transmission use; low-ALF techs (peakers, OCGTs) export rarely and thus are charged less.

Batteries, however, aren’t idle assets that should be charged less on that basis. Batteries are importers and exporters of energy are uniquely suited to flexibility provision. While they do export and import frequently, their flexibility makes them useful because they not only do not constantly export, but are able to absorb from the system as a pseudo generator. CMP393 would have ended batteries’ TNUoS fees by adjusting their ALF to zero.

If it had been successful, CMP393 would have been implemented from Spring 2025. This would be an indirect form of subsidy recognising storage as increasingly vital in an intermittent system.

In 2025, it was confirmed that CMP393 would not be implemented.

NESO’s rationale is that batteries should not to be doubly rewarded for this capacity, as the Balancing Mechanism (BM) is already locational. CMP393 would have given undue advantage to batteries over other constraint solutions, like Demand Side Management (DSM). Fair — exports still happen, the number isn’t zero, revenues are required to reduce systemic energy costs.

Still, demand-side management scale-ups are mostly exclusively suitable for I&C customers with stable, predictable loads and in-built redundancy.

The costs of demand side management also get socialised through initiatives like P415 whereby all wholesale actors pay for the difference in suppliers books from what they bought to what actually gets utilised. Whatever imbalance gets addressed by Virtual Lead Parties (VLPs) is offset by spreading the cost of whatever excess energy suppliers bought in advance, because there is nothing stopping suppliers to add it on everyone’s energy bills.

Stability is still prized over flexibility, or at the very least, the cost distribution is still a political choice. It is not about accuracy.

Why are batteries so important alongside calibration?

Batteries are important as calibration hedges, as well as providing flexibility. Batteries offer a support when the centres of generation are close to areas of low demand (such as Scotland) and the electricity has to face the volume constraints through the transmission “highway” that has to take the excess generation all the way to the areas of high demand (South of England) — while energy prices fail to reflect this reality.

Again: an uniform energy price without locational incentives fails to reflect:

Where batteries and flexibility provision are needed.

The constraints that the network faces for demand.

Where investment needs to flow due to the price not reflecting these signals.

Which technologies are ideally required or incentivised in specific geographies.

The carbon externalities of network operation and constraint management.

A lot of piecemeal adjustments are required. Which of these gets rejected, and on what basis, reflects the political priorities of the GB energy system.

Final words

The charges for the security and decarbonisation programs are distributed evenly across the population, which is regressive. Higher-income groups contribute more emissions and benefit more from the green transition, by having financial access to the initiatives that profit most from the transition’s dynamic tariffs by affording solar panels, batteries, heat pumps, and electric vehicles. Hence, since it is financed equally via bills, it is financed regressively. This costly transition is an economic shock, and it does no good to alleviate reactionary populist backlash against the clean energy transition. To ensure broad support and enable advanced demand response, progressive funding is crucial.

By calibrating locational pricing signals and incentivising investment in geo-technologically specific ways the UK can galvanise support for a more economically efficient energy transition. By reconsidering the cost distribution, it could do so in more equitable ways.

At the time of publishing the first version of this piece, I included views on expanding the enforcement of smart meters which now I have deleted. I am reconsidering, in light of further study and observing these systems being used as payment surveillance — for progress that continues to be financed regressively.

This introduction and article were originally created in 2024, as the REMA debate on whether zonal or nodal pricing would be adapted. This article is the same in the use of words and its focus. Nonetheless, it has new and important clarifications, as my thoughts return to the importance of flexibility and batteries.